During times of economic uncertainty and when the stock market is volatile, life insurance may be a useful tool to consider.

Income protection

Finances that were intended to provide support for you and your family could take a hit due to stock market volatility. In addition, rising costs of goods and services might eat into more of your income and savings. If you die, life insurance can be used to help replace some of the savings you may have lost during turbulent economic times. The tax-free death benefit may be used to help provide income to your spouse and family, pay off mortgages and loans, meet tax liabilities, or pay for college expenses.

Portfolio diversification

Certain types of permanent life insurance have a cash value option that can be beneficial during times of economic uncertainty. Some policies offer minimum interest rate guarantees (subject to the financial strength and claims-paying ability of the issuer) that may provide an alternative to the unpredictability of the stock market.

Wealth accumulation

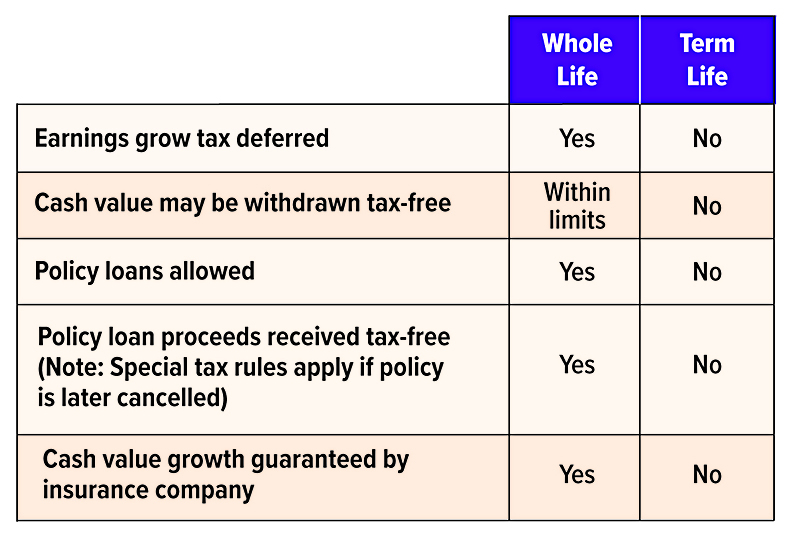

Cash value life insurance may allow all interest and earnings on the policy’s accumulations to grow tax deferred. You might even be able to take withdrawals from the cash accumulation of the life insurance policy. Any withdrawal you make will typically be tax-free up to your basis (i.e., premiums paid) in the policy. Because any earnings grow tax deferred while inside the policy, they will be subject to income tax when you withdraw them. Withdrawals coming out of your policy are generally treated as basis first. Be aware that surrender charges may also apply when you withdraw from your policy, even if you withdraw only up to your basis. One way to help circumvent this and still access your policy’s accumulations is to take out a policy loan from the insurance company, using the cash value in the policy as collateral. The amount you borrow is generally not treated as taxable income as long as you repay the loan, and there are no surrender charges because you’re not actually withdrawing your money. But you’ll have to pay interest on the loan, which is not tax deductible.

Living benefits

Life insurance could help replace lost funds should you become disabled, need long-term care, or face a terminal illness. For example, if you are terminally ill, you might be able to receive a portion of the death proceeds from your life insurance before you die in order to pay necessary expenses. Some life insurance policies include a special rider that allows you to accelerate your life insurance death benefit if you need long-term care. Other riders may be added to a life insurance policy that could help in the event you become disabled and are unable to work.

IMPORTANT DISCLOSURES

ERB FINANCIAL offers Securities and Investment Advisory Services through Ashton Thomas Securities, LLC, member FINRA/SIPC,200 Canal View Blvd Rochester NY 14623 585-424-1234

Locally owned and operated since 1953

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

This communication is strictly intended for individuals residing in the state(s) of NY. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2025.