When thinking about life insurance, you might focus on the death benefit that can be used for income replacement, business continuation, and estate preservation. But life insurance policies may include other provisions that allow you to access some or all of the death benefit while you are living. These features are often referred to as living benefits, which are usually offered as optional add-ons called riders.

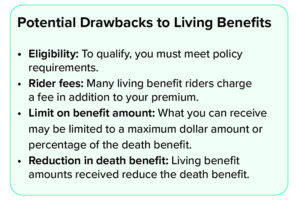

Some living benefit riders are added to a life insurance policy at no additional cost. Other riders are optional and come with an added cost to your basic policy premium. Living benefits vary depending on the type of life insurance and the company issuing the policy. Generally, living benefits are available to the policy owner, but using your living benefits will reduce the life insurance death benefit available for policy beneficiaries.

However, most riders let you take a portion of the total amount available — you don’t have to take the full amount so you can preserve a portion of the death benefit for your life insurance beneficiaries. Generally, living benefits are received free of income tax. Here are some common living benefits.

Accelerated Death Benefit for Terminal Illness

An accelerated benefit rider for terminal illness allows you to access a portion or all of the death benefit if you are diagnosed with a terminal illness or medical condition with a life expectancy of six to 24 months, depending on specific policy provisions. Most accelerated death benefit riders do not restrict how you use the money from the death benefit — you can use the money to help pay medical bills or other expenses arising from your illness. Or you can use the money to pay for funeral expenses.

Chronic Illness Rider

A chronic illness rider allows you to use a portion of your death benefit if you become chronically ill and cannot perform at least two of six activities of daily living (ADLs). These ADLs include bathing, continence, dressing, toileting, eating, and transferring. You may file a claim using this rider to receive a portion or possibly all of the death benefit. Usually, the insurance company will want to evaluate your claim and may require that you be examined by a medical professional chosen by the insurer. Often there are no restrictions on how you use the proceeds.

Critical Illness Rider

Critical Illness Rider

Similar to the chronic illness rider, the critical illness rider allows you to receive some or all of the death benefit if you are diagnosed with an illness or medical condition specified in the policy. Common critical illnesses include heart attack, stroke, cancer, end-stage renal failure, ALS, major organ transplant, blindness, or paralysis. With some critical illness riders, the percentage of death benefit available to you is based on the type of illness you have.

Long-Term Care Rider

A long-term care rider can be added to a life insurance policy, generally for an additional cost, to help cover qualifying long-term care expenses. Like the chronic illness rider, you must be unable to perform at least two of six ADLs to claim a benefit. Unlike the chronic illness rider, the long-term care rider usually pays a portion of the death benefit on a periodic basis, commonly monthly. Some riders have a waiting period during which you must incur long-term care expenses before you can receive any proceeds. Other riders may only require that you cannot perform at least two of six ADLs, after which you receive periodic payments to use any way you wish.

The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. Before implementing a strategy involving life insurance, it would be prudent to make sure that you are insurable. An individual should have a need for life insurance and evaluate the policy on its merits as life insurance. Optional benefit riders are available for an additional fee and are subject to contractual terms, conditions, and limitations as outlined in the policy and may not benefit all investors. Any payments used for covered long-term care expenses would reduce (and are limited to) the death benefit or annuity value and can be much less than those of a typical long-term care policy. Policy guarantees are contingent on the financial strength and claims-paying ability of the insurance provider.

Link to Printable PDF: 2022 07 July Newsletter

|