Three Ways to Help Build Financial Resilience

Roller-coaster markets, global events, and unexpected life changes can catch you off guard. Little wonder that you might worry about the potential effects on your financial well-being. Fortunately, you can take steps to build the resilience you need to help handle challenging times and hopefully emerge even stronger.

Fortify your foundation

Developing a new budget or reviewing an existing one may help reduce stress and feelings of vulnerability by reminding you that you still have control over many aspects of your personal finances. A budget is a foundational tool that outlines your income and expenses and shows how much money you have coming in compared to how much money you have going out. If you find that you are spending more than you realized, you can make adjustments.

An important companion to a budget is an emergency fund. When you have an unexpected expense, you can use your emergency reserves to cover it instead of dipping into long-term savings or racking up costly credit card debt that could throw your budget off track at a time you can least afford it. Consider starting an emergency fund and building it up over time. Having some short-term savings might also help you get through difficult economic times.

Stress-test your portfolio

When you’re investing for retirement or another financial goal, assessing the potential impact of various scenarios may help you prepare for and manage the financial impact of unexpected events. This could be done using computer simulations to analyze how your portfolio might perform. Doing this at regular intervals may help take some of the emotion out of decision-making during stressful times, helping you address gaps and opportunities.

There is no assurance that a simulation will be accurate. Because of the many variables involved, you should not rely on simulations without realizing their limitations. All investing involves risk, and there is no assurance that any financial strategy will be successful.

Anticipate future challenges

Of course, you’re never going to be prepared for every financial scenario. But developing a written financial strategy and reviewing it periodically may help you thoughtfully navigate life’s twists and turns. It documents and organizes the pieces of your financial picture, helping you stay focused on the future as you weather current storms.

Building financial resilience is an ongoing process, and it’s never too late to start. Becoming better positioned for downturns can help you feel more confident that you can handle whatever challenges come your way.

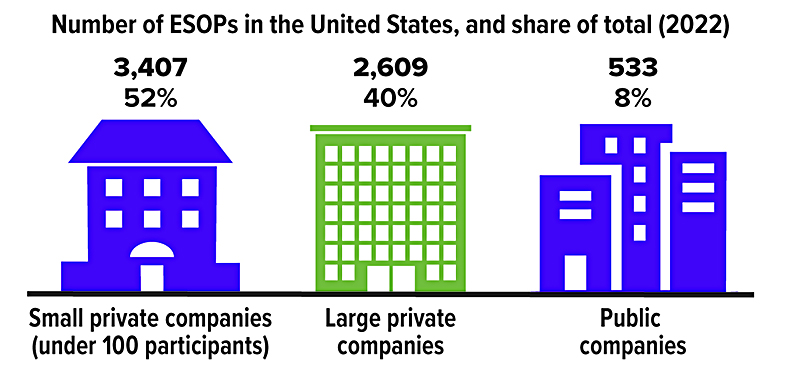

Could Employee Ownership Be Part of Your Succession Plan?

An employee stock ownership plan (ESOP) is a type of qualified retirement plan that enables a business owner to gradually transfer ownership shares to employees. Moreover, establishing an ESOP sets up opportunities for the owner of a closely held business to cash out (in whole or in part) in the future, while keeping the company going for employees and the community.

An ESOP may be a good option for small-business owners who don’t plan to pass the reins to family members when they retire, but instead have loyal and capable managers who would be interested in taking over the company. In the meantime, an ownership mentality may enhance efficiency and productivity, because employees have a stake in the company’s long-term success.

How ESOPs work

ESOPs are designed to invest their assets primarily in company stock rather than investing in the public markets. Annual cash contributions are made to the ESOP and used to purchase stock from the company, or the company may contribute the stock directly. In either case, the company can take a tax deduction for the value of each year’s contribution, while the cash stays with the company.

Unlike other retirement plans, ESOPs are permitted to borrow money to purchase company stock. The company then makes annual contributions to the ESOP in the amount equal to the ESOP’s principal and interest payments on the loan and uses the contributions to pay back that debt. The company’s contribution as a whole is deductible, so the interest and the principal on the loan are deductible as well.

With an ESOP, an employee never buys or holds the stock directly while still employed with the company. If an employee is terminated, retires, becomes disabled, or dies, the plan will distribute the vested shares of stock in the employee’s account.

ESOP participants are investing heavily in a single stock, and their investment is tied to the financial health of the business. If the company declines in value, the ESOP may also. Thus, an ESOP should generally be offered alongside a standard retirement plan [such as a (401k)] with more diversified investment options.

A tax-deferred exit

There may also be tax benefits for a retiring owner who sells a business to an ESOP. If the ESOP owns at least 30% of the company after the sale, the capital gains tax on the sale may be deferred by reinvesting the proceeds in domestic U.S. securities (“qualified replacement property”). No tax would be due until the replacement securities are sold. If they are held until death, a stepped-up basis may apply, and the original gain may never be taxed.

Business owners can defer taxes on the sale of business interests to an ESOP only if the shares were held for at least three years, and if the ESOP was established by a C corp (not an S corp). Among other conditions, stock bought by the ESOP may not be allocated to the seller or certain members of the seller’s family, or to any shareholder of the company establishing the ESOP who owns more than 25% of any class of company stock. If this rule is violated, the company would be subject to a 50% excise tax, and the person receiving the allocation would also be subject to tax consequences.

ESOPs can be complicated and costly to establish and maintain, but they offer significant tax advantages that make them worthwhile in certain situations. It would be wise to consult an attorney with experience in the formation and maintenance of qualified retirement plans to help evaluate whether an ESOP could be appropriate for your business.

All investing involves risk, including the possible loss of principal. There is no guarantee that any investing strategy will be successful. Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss.

Unpacking the Real Limits on Unlimited PTO

About 7% of U.S. companies offered unlimited paid time off (PTO) as an employee benefit in 2024, up from just 1% in 2014.1 When companies adopt unlimited PTO policies, there is no specific cap on the number of paid vacation and/or sick days employees can take, although requests for time off are typically subject to a manager’s approval.

With traditional benefit programs, long-time employees accrue more paid vacation days than newer hires. On average, private-industry employees in the United States can take 11 vacation days after one year of service, which rises to 15 days after five years, 18 days after 10 years, and 20 days after 20 years.2

Surveys confirm that unlimited PTO is a coveted workplace benefit that could be a powerful recruitment tool for companies that offer it.3 It’s easy to understand why the prospect of unlimited PTO is appealing, but there are also some potential pitfalls to consider.

A perk for employees and employers

Many employees appreciate the freedom to travel and take time off when needed for their own well-being or to help care for children or other family members. Thus, when companies have unlimited PTO policies that truly provide flexibility, it can help companies keep productive employees they don’t want to lose.

One drawback for employees with unlimited PTO is that there is no time bank of unused vacation days to cash out when they leave their jobs or get laid off. This amounts to significant savings for employers that have fluid workforces or decide to reduce their headcounts.

Employee perceptions and fears

Data shows that employees with unlimited PTO take an average of 16 days off a year, compared with 14 days taken by those with specific caps.4 Few employees abuse unlimited PTO policies, likely for the same reasons that many employees don’t use up the vacation days in their time banks. Some people don’t feel comfortable asking for time off if they are worried about keeping up with a heavy workload or if they will have to ask co-workers to cover their duties. And they might fear being judged negatively by their peers or managers, especially if they suspect it could impact their performance ratings and job security.

Company culture matters

Some start-ups have a reputation for “all-in” cultures in which taking time off is discouraged or can be especially stressful. The reality is that there are plenty of work environments that make it hard for employees to pursue work-life balance.

When their PTO is uncapped, employees must figure out for themselves how much time they can really afford to take. As always, the answer likely depends on company and industry norms and the individual worker’s standing and responsibilities.

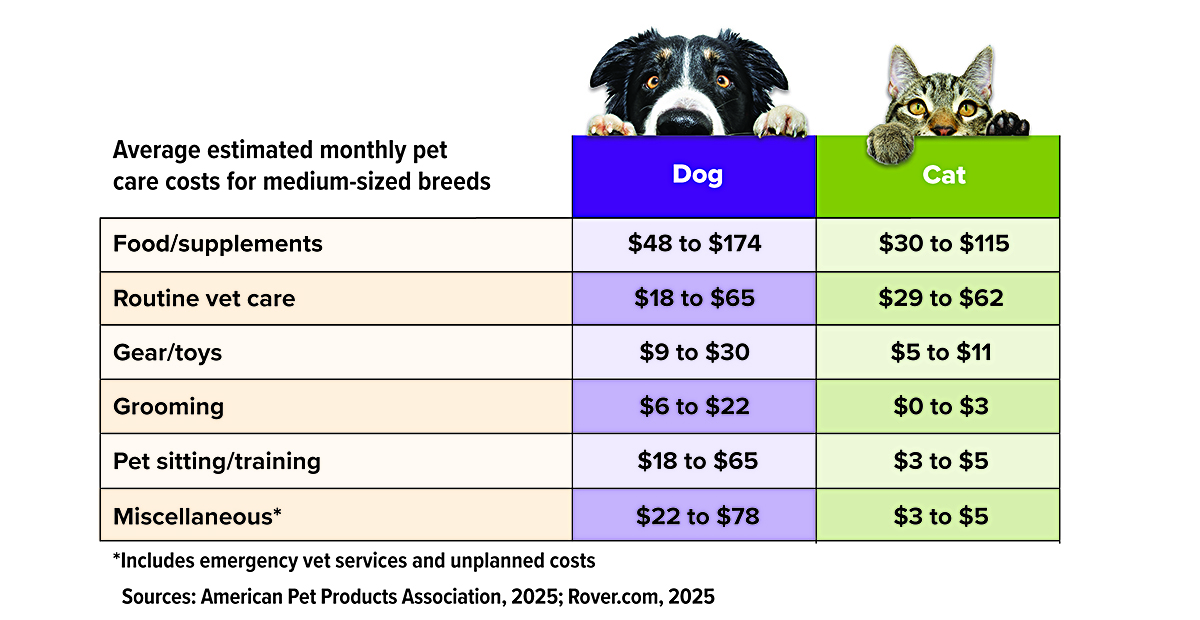

Planning for a Pricy Pet

Pets can be great companions, so it’s probably not surprising that 94 million U.S. households own at least one. But pets can also be expensive to care for, and costs are rising. According to one survey, average pet costs increased 9% for a dog and 11% for a cat in 2024 and are projected to rise even more — as much as 7% for a dog and 10% for a cat in 2025. Costs vary based on factors such size, breed, age, and health, but knowing how much you might spend to care for your pet can help you plan for the impact on your budget.

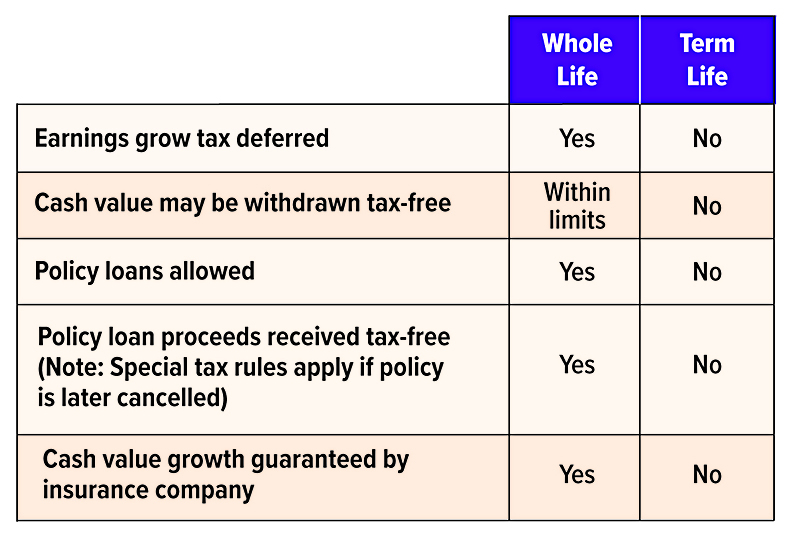

Life Insurance Might Help During Turbulent Economic Times

During times of economic uncertainty and when the stock market is volatile, life insurance may be a useful tool to consider.

Income protection

Finances that were intended to provide support for you and your family could take a hit due to stock market volatility. In addition, rising costs of goods and services might eat into more of your income and savings. If you die, life insurance can be used to help replace some of the savings you may have lost during turbulent economic times. The tax-free death benefit may be used to help provide income to your spouse and family, pay off mortgages and loans, meet tax liabilities, or pay for college expenses.

Portfolio diversification

Certain types of permanent life insurance have a cash value option that can be beneficial during times of economic uncertainty. Some policies offer minimum interest rate guarantees (subject to the financial strength and claims-paying ability of the issuer) that may provide an alternative to the unpredictability of the stock market.

Wealth accumulation

Cash value life insurance may allow all interest and earnings on the policy’s accumulations to grow tax deferred. You might even be able to take withdrawals from the cash accumulation of the life insurance policy. Any withdrawal you make will typically be tax-free up to your basis (i.e., premiums paid) in the policy. Because any earnings grow tax deferred while inside the policy, they will be subject to income tax when you withdraw them. Withdrawals coming out of your policy are generally treated as basis first. Be aware that surrender charges may also apply when you withdraw from your policy, even if you withdraw only up to your basis. One way to help circumvent this and still access your policy’s accumulations is to take out a policy loan from the insurance company, using the cash value in the policy as collateral. The amount you borrow is generally not treated as taxable income as long as you repay the loan, and there are no surrender charges because you’re not actually withdrawing your money. But you’ll have to pay interest on the loan, which is not tax deductible.

Living benefits

Life insurance could help replace lost funds should you become disabled, need long-term care, or face a terminal illness. For example, if you are terminally ill, you might be able to receive a portion of the death proceeds from your life insurance before you die in order to pay necessary expenses. Some life insurance policies include a special rider that allows you to accelerate your life insurance death benefit if you need long-term care. Other riders may be added to a life insurance policy that could help in the event you become disabled and are unable to work.

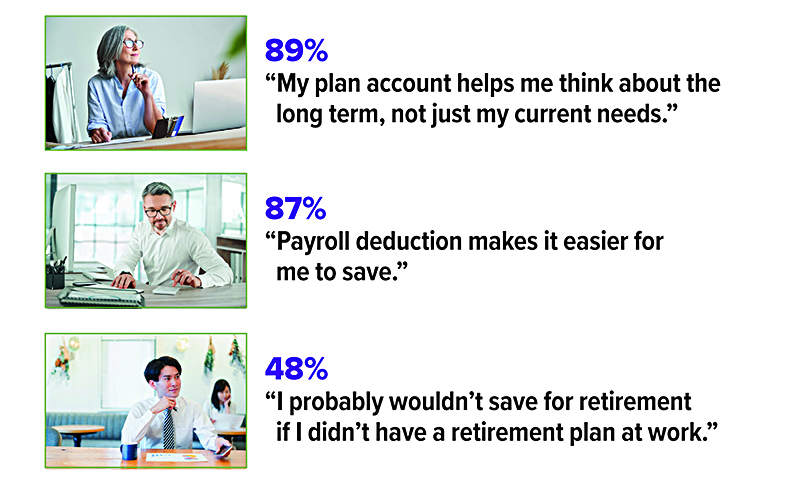

How Has SECURE 2.0 Affected 401(k) Plans?

Since its inception in 1980, the 401(k) plan has become a key tool in helping Americans build wealth. In fact, the number of people who have become millionaires through their 401(k) plans reached 537,000 in 2024, a 27% increase from 2023.1 The SECURE 2.0 Act, passed in 2022, introduced new features designed to make 401(k)s even more appealing to workers. The following features are optional for employers, and while some have been adopted, others have yet to gain traction.

Emergency access

In most cases, early withdrawals from 401(k) plans are subject to ordinary income tax and an additional 10% early distribution penalty. However, there are certain exceptions to the penalty, including several introduced by SECURE 2.0:

- Withdrawals of up to $1,000 for personal or family emergencies

- Distributions of up to $22,000 for expenses related to a federally declared natural disaster

- Withdrawals of up to the lesser of $10,500 (in 2025) or half the account balance for an account holder who is the victim of domestic abuse

- Distributions to a terminally ill employee

In addition, SECURE 2.0 ushered in a new option to help employees save for emergencies, known as a pension-linked emergency savings account (PLESA). Also called a “sidecar” account, a PLESA allows workers to make Roth-type contributions, which means they are not tax deductible, but withdrawals are tax-free. Employees can save up to $2,500 each year (or a lower limit, as determined by the employer), and money is invested in lower-risk vehicles. Employees are allowed to make withdrawals at least once per month, generally for any reason.

SECURE 2.0 also authorized employers to allow workers to “self-certify” their need for hardship withdrawals, which are distributions permitted in certain situations if the employee has limited financial resources. Previously, employees were required to prove they had an “immediate and heavy financial need” for the money. (Note that hardship withdrawals and $1,000 emergency withdrawals are different types of distributions.)

Super catch-ups

Catch-up contributions, which allow employees age 50 and older to contribute more to their 401(k) plans than younger workers, have existed since 2001. Thanks to SECURE 2.0, employers may now allow workers who reach age 60 to 63 during the year to contribute even more through what have become known as “super catch-ups.” In 2025, all 401(k) plan participants can contribute up to $23,500. Employees age 50 to 59 and 64 and older can contribute an additional $7,500, and those who reach age 60 to 63 can contribute an additional $11,250. These limits are indexed to inflation, which means they are periodically increased.

Student loan match

This program is designed to help alleviate the risk that some workers may be unable to save for retirement while paying off student debt. Through the student loan match, employers can make matching contributions into a retirement savings account based on an employee’s student loan payments.

Roth match

With this option, employees can have their employer matching and non-elective contributions invested on a Roth, rather than a pre-tax, basis. The benefit is that, under current law, this feature can help workers build a source of potentially tax-free retirement income, provided certain conditions are met. A Roth distribution is tax-free if it is made after the account has been held for at least five years and the employee reaches age 59½, dies, or becomes disabled.

Which features are being adopted?

The new exceptions to the 10% penalty, the self-certification for hardship withdrawals, the super catch-ups, and the Roth matches are among the new plan features employers are adopting. On the other hand, employers have been slow to launch PLESAs and offer the student loan match. Industry observers indicate it may be due to the technology and/or added administrative burden these features require. In the case of the student loan match, some plan sponsors have noted that not enough employees have a need for the benefit.2

Boomer Homeownership and Retirement

With the youngest baby boomers turning 60 in 2024, a survey from mortgage agency Freddie Mac looked at the relationship of boomer homeownership to retirement and aging. Here are some of the findings. All percentages apply to baby boomers (born 1946 to 1964), who hold about half the nation’s home equity, amounting to more than $17 trillion.

IMPORTANT DISCLOSURES

ERB FINANCIAL offers Securities and Investment Advisory Services through Ashton Thomas Securities, LLC, member FINRA/SIPC,200 Canal View Blvd Rochester NY 14623 585-424-1234

Locally owned and operated since 1953

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

This communication is strictly intended for individuals residing in the state(s) of NY. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2025.